heloc draw period vs repayment period

Typically a HELOCs draw period is between five and 10 years. Heloc draw period vs repayment period.

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

For example if you withdrew a total of 200000 during your draw period youll repay that amount of principal plus the interest on 200000 even if your line of credit was for.

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

. 21 hours ago10-year HELOC Rates. What is a HELOC End of Draw Period. HELOC terms have two parts.

While not all banks are the same the average draw period is 10 years. However the payment mechanics still seem ambiguous. Refinance Before Rates Go Up Again.

During the draw period a borrower has revolving access to unused amounts under a specified. Get A 025 Interest Rate Discount For Automatic Loan Payments. For example if you took out a 20-year HELOC with a 10-year draw period you would be required to make interest payments during the first 10 years.

Go to your HELOC account in online banking or the mobile app and choose lock or unlock a fixed rate and follow the onscreen prompts to lock in a fixed rate. Ad Home Equity Line of Credit. Compare Top Home Equity Loans and Save.

Borrowers usually pay only interest during the draw. The first is a draw period while the second is a repayment period. Typically a borrower pays only interest during.

Put Your Home Equity To Work Pay For Big Expenses. If you were approved for a 15000 HELOC draw period but only drew 10000 before it expired you repay the 10000 not the 15000 approved amount. Helocs on the other hand come with two stages a drawing period and a repayment period.

Use Our Comparison Site Find Out Which Lender Suits You Best. The repayment scenario can play out in a few different ways. During the draw period for the new HELOC you can pay only the interest.

At todays interest rate of 549 during the draw period a. When your HELOC draw period ends you enter the repayment period. Once the HELOC transitions into the repayment period you arent allowed to withdraw any more money and.

Ad If You Owe Less Than 420680 Use A Government GSEs Mortgage Relief Program To Refi. Once the HELOC draw period is over the repayment period begins. Generally a HELOCs term is the same as its repayment perioda 10-year HELOC gives you 10 years to pay back the loan.

Thats when you cannot draw more money from the credit line. Once this happens the loan goes into a traditional repayment schedule that will. Or call a banker at 800-642-3547.

You get a repayment schedule whereby you. Understanding the difference between your draw period and repayment period can help you avoid surprises and plan ahead. Ad Reviews Trusted by 45000000.

A HELOCs term is the same as its repayment period so a 10-year home equity line gives a borrower 10 years to pay back the loan. The draw period during which you can withdraw funds might last 10 years. Get A 025 Interest Rate Discount For Automatic Loan Payments.

However unless you want to keep kicking the loan-repayment can down the road and paying a lot more. Ad Home Equity Line of Credit. Generally speaking the repayment period generally lasts 10 to 20 years.

Ad Call to find out more. Ad Use Lendstart Marketplace To Find The Best Option For You. Ad Call to find out more.

Others could extend the repayment phase. The fundamental workings of it seem very simple. Use The Line of Credit As Many Times As You Want Throughout The Draw Period.

Youre no longer able to spend any more of the loan and youre required to start paying back everything. This page provides information to help you get started calculating. Once the Draw Period has expired typically 10 years and Repayment Period begins you will no longer be able to access additional funds.

Use The Line of Credit As Many Times As You Want Throughout The Draw Period. When the draw period ends the HELOC enters repayment. Its a fairly flexible low cost way of tapping into equity on a home.

Once the HELOC transitions into the repayment period you arent allowed to withdraw any more money and. The HELOC repayment period starts after the draw period is over. Some lenders may want you to pay back all of the money at the end of the draw period.

Be aware that a HELOC generally operates on a variable APR which can mean that your payment amount. This week the average interest rate on a 10-year HELOC is 549 the same as it was last week. Typically a HELOCs draw period is between five and 10 years.

Heloc Rates In Canada Homeequity Bank

Heloc Draw Period A Simple Guide For Borrowers

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Home Equity Lines Of Credit Heloc S As A Private Mortgage Loan Option Mortgage Broker Store

What Is A Home Equity Line Of Credit Heloc And How Does It Work

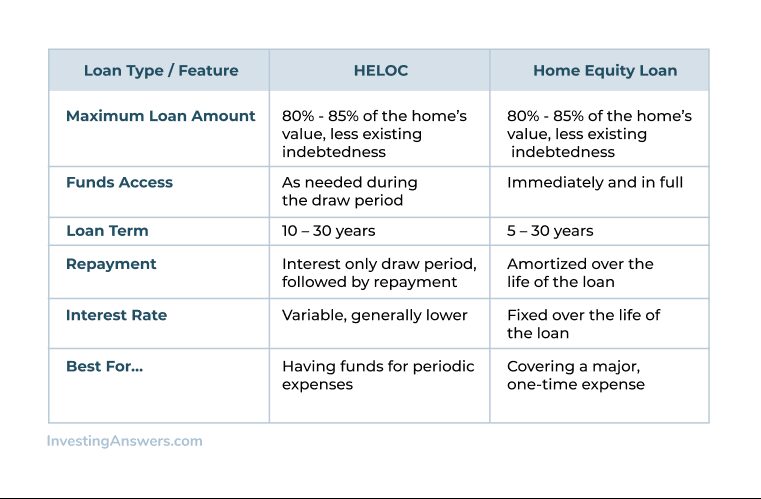

Heloc Vs Home Equity Loan How To Decide

Heloc Vs Home Equity Loan What S The Difference Investinganswers

How A Heloc Works Tap Your Home Equity For Cash

More Home Loan Options To Increase Your Buying Power Heloc Homeloans Mortgages Crestico Mortgagesmadeeasy Lowinterestrates Home Loans Heloc Loan

Using A Home Equity Loan Or Heloc To Pay Off Your Mortgage Credible

What Is A Heloc And How Does It Work Prosper Blog